The Tasman Capital Trading transaction report does not give a direct breakdown of your profit/loss. However, it provides all the data necessary to calculate capital gains and losses over a period of time.

How to use Tasman Capital Trading transaction reports

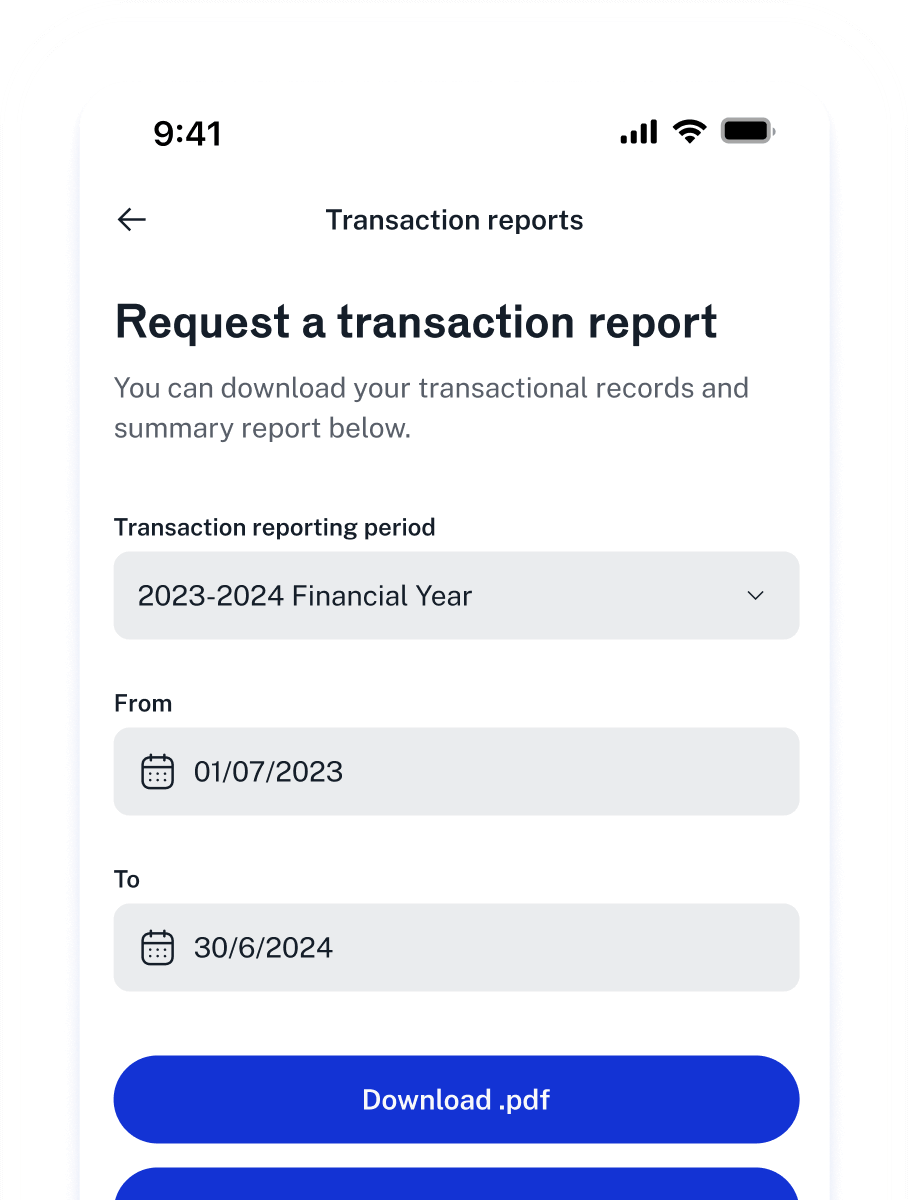

Visit transaction reports

Choose date range

Download report

Can a I get a profit/loss breakdown from transaction reports?

Does a transaction report tell me how much tax I have to pay?

No, a transaction report will not tell you how much tax is owed to the ATO. This is because Tasman Capital Trading cannot account for cryptocurrency trading that has occurred on other exchanges. Additionally, each individual will have a unique Capital Gains Tax (CGT) rate depending on their earnings. However, Tasman Capital Trading has partnered with Koinly, an Australian company that can help generate a tax report based on your Tasman Capital Trading transactions.

Can I submit a transaction report to the ATO?

No, the Tasman Capital Trading transaction report cannot be directly submitted to the ATO. However, the data included can be used to help build an eligible tax report. If you are struggling, consult a tax professional.

How do I know how much tax I have to pay?

There are several elements that can influence how much tax is owed to the ATO, including capital gains, lotsses, job earnings and transactions on other exchanges/using other assets. Using Koinly’s third-party API on the Tasman Capital Trading platform can help manage tax obligations. When in doubt, consult a professional.